Bitcoin mining can still make sense and be profitable for some people. In an effort to remain competitive, some machines have adapted. Cloud mining involves buying time on someone else's platform. Companies like Genesis Mining and HashFlare charge you based on what is called a hash rate, basically, your processing power.

If you buy a higher hash rate, you are expected to receive more coins for what you pay, but it will cost you more. As things stand, depending on what you mine, it may take several months before your cloud mining investment becomes profitable. However, at least with cloud mining, you don't have to worry about energy consumption costs and other direct costs related to conducting all mining with your own platform. Another option is to mine bitcoins, since as long as the markets remain active, you can basically make money for nothing.

But the problem is that mining is such a difficult job now that it's not worth it. Turning your computer into a miner will probably cause it to make noise and heat up. It would probably take a long time for him to mine a single Bitcoin, at which point he would probably have spent more on electricity. The IRS has been looking to crack down on cryptocurrency owners and traders as asset prices have skyrocketed in recent years.

For example, in the case of Bitcoin, miners validate transactions on the blockchain and are rewarded with Bitcoin for their efforts. This includes investing in Bitcoin, other forms of cryptocurrency stocks, or memes such as Gamestop or AMC. You want your machine to remain profitable for several years so that you can earn more bitcoins than you could have gotten by simply buying the cryptocurrency itself. Buy Bitcoin Worldwide receives compensation regarding its referrals for outgoing cryptocurrency exchanges and crypto wallet websites.

Bitcoin and other cryptocurrencies remain a high-risk, high-reward investment, with little consensus on the economic role they will play in the coming years. Cryptocurrency is a form of digital currency backed by a form of cryptography often referred to as blockchain. As the difficulty of mining bitcoins increases and the price lags behind, it becomes increasingly difficult for small miners to make a profit. However, if you are a professional miner like F2 or Bitmain, you are likely to have really advantageous agreements with OTC desks to sell your coins at little or no cost, depending on the state of the market.

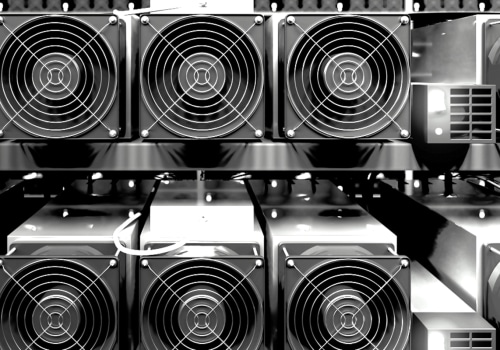

PPS+ groups eliminate miners risk by paying block rewards and transaction fees to miners, regardless of whether the group itself successfully mines each block. While mining may have been relatively easy in the early days of cryptocurrencies, it has become a highly competitive business. In other words, the more miners (and, therefore, the computing power) you mine bitcoin and wait for a reward, the harder it will be to solve the puzzle. When mined to earn cryptocurrencies such as bitcoin and ether, complex computers are programmed to compete and solve difficult puzzles in order to validate transactions.

Imagine that you and a friend decide to become miners, but your friend can afford nine high-end GPUs and you can only afford one. If the difficulty did not increase with new miners, then bitcoins would be mined more often as more miners joined, and that increase in supply could reduce value.