In the United States, cryptocurrencies have been the focus of much attention from both the federal and state governments. At the federal level, most of the focus has been at the administrative and agency levels, including the Securities and Exchange Commission (the “SEC), the Commodity Futures Trading Commission (the “CFTC), the Federal Trade Commission and the Department of the Treasury, through the Internal Revenue Service (the” IRS), the Office of the Comptroller of the Currency (the “OCC) and the Financial Crimes Enforcement Network (“FinCEN). While there has been significant commitment on the part of these agencies, there has been little formal regulation. Many federal agencies and policy makers have praised technology as an important part of the United States,.

Maintain a leadership role in technology development. There is no uniform definition of “cryptocurrency”, often referred to as “virtual currency”, digital assets, digital tokens, crypto assets, or simply “crypto”. While some jurisdictions have tried to formulate a detailed definition for the asset class, most have wisely opted for broader, technology-independent definitions. Those who adopt the latter approach will be better positioned to regulate as technology evolves.

This is discussed in detail below. The sale of cryptocurrency is generally only regulated if the sale (i) constitutes the sale of a security under state or federal law, or (ii) is considered money transfer under state law or conduct that otherwise makes the person a money service company (“MSB”) under federal law. In addition, contracts for futures, options, swaps and other derivatives that refer to the price of a crypto asset that constitutes a commodity are subject to regulation by the CFTC under the Commodity Exchange Act. In addition, the CFTC has jurisdiction over attempts to engage in market manipulation with respect to those crypto assets that are considered commodities.

The likelihood that the CFTC will assert its authority to prevent market manipulation is much higher today as a result of both the CBOE and the CME offering futures linked to the price of Bitcoin. The SEC generally has regulatory authority over the issuance or resale of any token or other digital asset that constitutes a security. Law, a security includes “an investment contract, which has been defined by the U.S. UU.

Supreme Court as an investment of money in a joint venture with a reasonable expectation that profits will be derived from the business or management efforts of others. Certain market professionals have tried to highlight the usefulness or coupon-like characteristics of their proposed ICOs in an effort to claim that their proposed tokens or coins are not securities. Many of these claims that federal securities laws do not apply to a particular ICO seem to elevate form over substance. The increase in these form-based arguments is a disturbing trend that deprives investors of the mandatory protections that are clearly required as a result of the transaction structure.

Just calling a token a “utility” token or structuring it to provide some utility doesn't prevent the token from being a value. The outcome of Telegram and Kik's procedures has made it incredibly difficult to consummate most of the token generating events involving the US. USA, S. Many issuers have chosen to exclude the U.S.

The people of token offerings, and instead have chosen to limit sales to outside the US. People (for example,. With little prospect of legislative action, the hostile environment towards token generating events in the US. It is likely to continue for the foreseeable future.

In addition to federal securities laws, most states have their own laws, known as blue sky laws, which are not always preceded by federal law. Anyone who sells digital assets that may constitute a security should consult with an attorney about the applicability of blue sky laws. Of particular importance, there are certain registration exemptions under federal law that do not anticipate the application of state blue sky laws. Arizona became the first state in the U.S.

Adopt a “regulatory sandbox” to guide the development of new emerging industries such as fintech, blockchain and cryptocurrencies within their borders. The law provides regulatory relief for innovators in these sectors who want to bring new products to market within the state. Under the program, companies can test their products for up to two years and serve up to 10,000 customers before having to apply for a formal license. Since then, other states have followed suit and created similar programs, including Wyoming, Utah, Kentucky, Vermont, Nevada, and Hawaii.

Until the SEC provides further guidance on classifying individual cryptocurrencies as securities or commodities, the likelihood that many cryptocurrencies will be considered securities is high. As such, we recommend that cryptocurrency funds that invest in anything other than Bitcoin, Ether, Litecoin, and the handful of other clearly basic currencies, comply with the Companies Act on a preventive basis. For most start-up funds, this would mean limiting investors within a given fund to fewer than 100 beneficiaries. The general rule regarding Bitcoin mining remains relatively straightforward.

If you can own and use cryptocurrencies where you live, you should also be able to mine cryptocurrencies in that location. If owning cryptocurrencies is illegal where you live, it is most likely that mining is also illegal. There are few, if any, jurisdictions in the U.S. When the possession of cryptocurrencies is illegal.

Plattsburgh, New York, however, is probably the only city in the US. Imposing a (temporary) ban on cryptocurrency mining. The Marine Corps Banned Crypto Mining Apps on All Issued Mobile Devices. Lawmakers have proposed a requirement for people to declare their cryptocurrency holdings when entering the U.S.

Cryptocurrency, like Bitcoin, has value and is therefore increasingly likely to become a real estate asset. While there are few, if any, laws specific to cryptocurrencies, due to the nature of cryptocurrencies, typical wills and revocable living trusts may not be adequate to efficiently transfer this new type of asset. As a result, new questions and estate planning clauses may be necessary. Since transfers from a Bitcoin wallet and most wallets are irrevocable, private key information about your cryptocurrency accounts will need to be kept secure.

Security can be enhanced by storing private key information in a safe deposit box or vault, which can only be accessed after death by the personal representative designated in your will (or the designated successor trustee in your revocable living trust). According to the Financial Crimes Enforcement Network (FinCEN), cryptocurrency miners are considered money transmitters, so they may be subject to the laws governing that activity. In Israel, for example, crypto mining is treated like a business and is subject to corporate income tax. In India and elsewhere, regulatory uncertainty persists, although Canada and the United States seem favourable to crypto mining.

A war is brewing between states to attract bitcoin miners, and new data shows many of them are heading to New York, Kentucky, Georgia and Texas. A mining pool allows a single miner to combine their hashing power with thousands of other miners around the world, and there are dozens to choose from. Although the dataset only captures a portion of the country's domestic mining market, it points to national trends that are reshaping the debate around bitcoin's carbon footprint. Many of the top-ranking states are epicenters of renewable energy, a fact that has already begun to reframe the narrative among skeptics that bitcoin is bad for the environment.

Mining is not totally renewable, it does say that miners here are much better at selecting renewable energy and buying offsets. When Beijing decided to expel all its crypto miners this spring, about half of the bitcoin network went out virtually overnight. While the network itself didn't skip the pace, the incident triggered the largest migration of bitcoin miners ever seen. Take New York, which leads Foundry's ranking.

One third of its generation in the state comes from renewable energy, according to the latest data available from the U.S. New York counts its nuclear power plants to achieve its 100% carbon-free electricity target, and more importantly, New York produces more hydropower than any other state east of the Rocky Mountains. It was also the third largest producer of hydroelectricity in the nation. New York was weighing legislation this year to ban bitcoin mining for three years so that it could conduct an environmental assessment to measure its greenhouse gas emissions.

Since then, legislators have largely done so. Other states that capture a large portion of the U.S. bitcoin mining industry include Kentucky and Georgia. Beyond the fact that the governor of Kentucky is industry-friendly, having just passed a law this year that gives certain tax breaks to crypto mining operations, the state is also known for its hydroelectric and wind power.

Connecting platforms to otherwise stranded energy, such as natural gas wells, is another source of energy. While coal is also an important player in the energy mix, many mining operations there gravitate towards renewable energy. Texas may rank fourth according to Foundry's dataset, but many experts believe that there is no doubt that it is the top jurisdiction for miners right now. Some of the biggest names in bitcoin mining have established themselves in Texas, including Riot Blockchain, which has a 100-acre site in Rockdale, and Chinese miner Bitdeer, which is just down the street.

The regulatory red carpet being rolled out for miners also makes the industry highly predictable, according to Alex Brammer of Luxor Mining, a cryptocurrency group created for advanced miners. Some miners connect directly to the grid to power their platforms. ERCOT, the organization that operates the Texas grid, has the cheapest utility-scale solar energy in the country at 2.8 cents per kilowatt hour. The grid is also rapidly adding wind and solar energy.

Deregulated grids tend to have the best economy for miners, because they can buy spot energy. Another major energy trend in the bitcoin mining business in Texas is the use of stranded natural gas for power rigs, which reduces greenhouse gas emissions and generates money for gas suppliers, as well as miners. Do you have confidential news? We want to hear from you. Get this delivered to your inbox and learn more about our products and services.

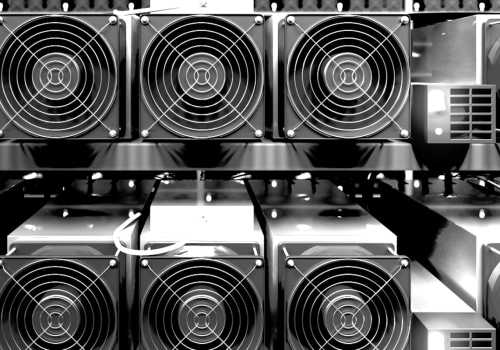

Of course, the tokens that miners find are virtual and only exist within the digital ledger of the Bitcoin blockchain. But miners will still be needed to verify transactions; therefore, after 2140, miners will be rewarded with fees paid by those who use the network. Cryptocurrency mining requires computers with special software specifically designed to solve complicated cryptographic mathematical equations. Despite increased demand for GPUs, the crypto mining gold rush quickly came to an end, as the difficulty of mining major cryptocurrencies such as Bitcoin increased just as quickly.

While options such as using Simple Agreement of Future Tokens (SAFT) have been considered as an alternative way for cryptocurrency startups to raise funds without violating securities laws, the SEC has not yet made a decision on their validity. To ensure that only verified crypto-miners can extract and validate transactions, a proof-of-work (PoW) consensus protocol has been implemented. The CryptoCompare site offers a useful calculator that allows you to connect numbers such as your hash rate and electricity costs to estimate costs and benefits. The CFTC defined bitcoin as a “commodity” and its efforts are primarily focused on monitoring the cryptocurrency futures market, a certain type of derivatives market that allows investors to speculate on price without actually buying the underlying commodity.

CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. While cryptocurrency is not mature enough to allow existing legal structures to enact a full set of rules and regulations, the technological nature of cryptocurrency allows estate planning to protect the intent of crypto-holding clients. FinCEN is the regulatory body that ensures that all exchanges and crypto service providers comply with all necessary measures against money laundering (AML) and terrorist financing. At its height, cryptocurrency mining was an arms race that led to increased demand for graphics processing units (GPUs).

However, in all cases, VAT will be due in the normal manner to suppliers of any goods or services sold in exchange for bitcoin or other similar cryptocurrency. Mining pools allow miners to combine their computational resources to increase their chances of finding and extracting blocks on a blockchain. . .