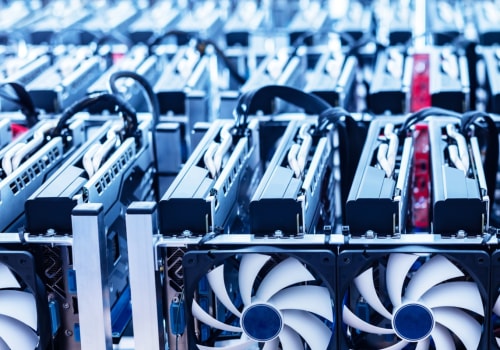

The most obvious environmental impact of cryptocurrencies is the electricity required for the mining process, which is how new digital currencies are created. While most know this as Bitcoin mining, many forms of cryptocurrency rely on mining. But since the launch of Bitcoin, it has become increasingly difficult to mint new currency units through mining. This was by design, since the coin had a ceiling of 21 million units, so the more units that are minted, the fewer units are available to mine and the more computational power is needed to mint new ones.

Environmentalists agree that “bitcoin mining” uses a worrying amount of fossil fuels. For years, bitcoin critics have defamed the world's largest cryptocurrency for polluting the planet. But new data from the University of Cambridge shows that the geography of mining has changed dramatically over the past six months, with experts telling CNBC that this will improve bitcoin's carbon footprint. The great crackdown on cryptocurrencies in China this spring triggered a chain reaction in the mining world.

On the one hand, it disconnected half of the world's bitcoin miners practically at night. Fewer people mining has meant fewer machines in operation and less energy consumption overall, which dramatically reduced bitcoin's environmental impact. Beijing's new crypto rules also permanently disconnected much older and inefficient equipment. And, crucially, the closing of China's doors to crypto mining has triggered a massive migration.

Miners are now targeting the cheapest energy sources on the planet, which in most cases are renewable. Today, bitcoin consumes approximately 70 terawatt hours of energy per year, or 0.33% of the world's total electricity production. That is almost half of what it was in May and is roughly equivalent to the annual energy consumption of countries such as Bangladesh and Chile. The exodus from China also means that many of the oldest mining equipment that was probably withdrawn a long time ago will never be reignited.

But not all miners in China are going dark. Many have begun to patriate elsewhere, gravitating towards the cheapest energy sources in the world. Because large-scale miners compete in a low-margin industry, where their only variable cost is energy, they are encouraged to migrate to the cheapest energy sources in the world. Data shows that many of these miners are heading to cheaper pastures in the U.S.

UU. The United States has quickly become the new hotspot for global crypto miners in the world. Over the past six months, the country has jumped from fifth to second place and now accounts for nearly 17% of all bitcoin miners in the world. Although China was still in first place in April, with a 46% share, the US market share is likely to be much higher now since the Chinese government boosted miners in May.

WE,. Whit Gibbs, CEO and founder of Compass, a bitcoin mining service provider, says retail sales of hardware and hosting have increased nearly 300% since mid-June. A new stablecoin issuer is buying billions of dollars worth of bitcoins. What cryptocurrency investors need to know Small investors are stepping up their bullish bets on bitcoin, open interest data shows In the long run, this is good news for bitcoin's carbon footprint.

Energy consumption is not equivalent to carbon emissions. While it is relatively easy to determine how much energy the bitcoin network consumes, it is much more difficult to determine its carbon footprint. An accurate reading of bitcoin's carbon emissions would require an accurate knowledge of the combination of energy used to generate the electricity used by each bitcoin mining operation. A hydropower unit, for example, does not have the same environmental impact as the equivalent amount of energy from coal.

And China's bitcoin mining operations were known both for. But overall, the market is pushing North American energy sources to be greener. Thiel says most new miners in North America will run on renewable energy, or gas will be offset by renewable energy credits. Gibbs estimates that bitcoin mining in the US.

It is powered by renewable energy by more than 50%. Miners migrating to North America are also preparing for a future where their energy use is questioned by potential investors, and possibly regulated. Brammer has been helping Chinese customers find new homes. He says that most are aware of the political and regulatory winds in North America and want to protect themselves against regulatory risks in the future by establishing new facilities in primarily renewable energy locations.

Bitcoin mining engineer Brandon Arvanaghi tells CNBC that, in the long run, migration to the US. Miami Mayor Francis Suarez has also popularized the idea of mining bitcoin with nuclear power in Florida. However, not all miners are heading to renewable destinations. However, several mining experts tell CNBC that they think that Kazakhstan, China's neighbor, is just a temporary halt in a longer migration to the west.

Brammer sees that the big miners will go there in the short term with older generation equipment. But as older generation machines reach the end of their useful lives, those companies will likely deploy new machines in more stable, energy-efficient and renewable jurisdictions, he said. Do you have confidential news? We want to hear from you. Get this delivered to your inbox and learn more about our products and services.

Facing intense criticism, the crypto mining industry is trying to change the view that its energy-intensive computers are damaging to the climate. A decentralized autonomous organization, or DAO, is an organizational structure built on blockchain technology that is often described as a crypto cooperative. The broader cryptocurrency community is divided over whether cleaning up the mining sector is the best path to environmental sustainability. The rise in the price of these online currencies has led to hysterical demands, encouraging millions of people to try their slice of the cryptocurrency pie, without understanding or considering the collateral environmental impact.

One of the main concerns about cryptocurrencies, including bitcoin and ethereum, is their lack of environmental credentials. China, Iran, Qatar, Morocco, Algeria and Egypt, among others, have formally banned cryptocurrencies and mining activities. While in relation to the financial system, the energy consumption of cryptocurrencies hardly compares, it is important to note that, since cryptocurrency has hardly replaced traditional banking or financial systems, the energy used by cryptocurrencies does not replace the energy consumption of the banking system, but rather is additional to it. The effort, partly a public relations exercise, partly a genuine attempt to make the industry more sustainable, has intensified since last spring, when China began cracking down on crypto mining, forcing some mining operations to relocate to the United States.

However, there are digital assets that are more energy efficient, which means that their environmental impact is reduced. Miners generate new bitcoins when processing transactions, which they do using special decryption software. As concerns increase about energy levels used in cryptocurrency mining, new initiatives are constantly emerging to improve the sector's environmental credentials. .

.